">

">

Torchlight Tax Announces Cost Segregation is a Missed Tax Break for Many Real Estate Investors

LAS VEGAS, NV: Torchlight Tax LLC., (https://torchlighttax.com), a full-service tax firm headquartered in Las Vegas, announced cost segregation-accelerated depreciation is a major tax break that many real estate investors are missing out on. Torchlight Tax is offering these services to real estate investors, large and small, across the USA. Dave Horwedel, CEO of Torchlight Tax, […]

">

">

Can You Deduct Your Crypto Losses as Fraud?

By Dave Horwedel, EA, and CEO of Torchlight Tax Yes. If you were the victim of fraud and can prove it. As an EA, my clients can sign form 2848 IRS Power of Attorney, and I can represent them before the IRS in the same way a tax attorney can. Under IRS rules, a fraud […]

">

">

How to Handle UNCONFRONTABLE Tax Debt: 2024 Update

by Dave Horwedel, EA This is a common situation in 2024. Many individuals and businesses took a hit on their income in 2024. Many got governmental assistance—federal unemployment compensation, Payroll Protection Program loans, Employee Retention Credit, and so on, during the Pandemic. Some taxpayers got a LOT of assistance. But now it is gone. Some […]

">

">

8 Simple Steps to Organize for Taxes and Improve Your Quality of Life

By Dave Horwedel, EA and CEO of Torchlight Tax. Tax filing can be a stressful time for many Americans. Here are eight simple steps to lower stress and save time and money. 1. Have a Stable Storage Space for Your Tax Documents “I have to get my documents together!” Does this statement sound familiar? We’ve […]

">

">

Save Thousands of Tax Dollars Renting Your Home to Your Business

By Dave Horwedel, EA Save Thousands of Tax Dollars Can you save several thousand tax dollars by renting your home to your business? Yes!! You must have a small business and a home and must be paying income tax!! Tax savings could range from a few thousand to $13,000, or even more. How It Works […]

">

">

Responding to the IRS: 2024 Update

by Dave Horwedel, EA First, do not panic!! Yes, it can be upsetting to receive a notice from the IRS. But the first step is to take a deep breath and calmly read the notice or letter. The notice or letter states the reason it was sent, its purpose, and instructions on how to respond. […]

">

">

Asset Protection in 2024

Reportedly, 40 million lawsuits are filed in America every year. This makes asset protection a high priority for Americans who wants to live well and keep and expand their assets. This is Dave Horwedel, CEO of Torchlight Tax and Financial Solutions. Our team of EAs, CPAs and Tax Attorneys work together to save your tax […]

">

">

Asset Protection Mistakes of Donald Trump: Lessons to Learn!

By Dave Horwedel, the CEO of Torchlight and GuardDog Tax. Millions of Americans are worried about protecting their assets, or SHOULD BE. 100 million lawsuits are reportedly filed in America annually. There are only about 132 million households in America. That is almost one lawsuit per household per year. Consider Donald Trump–a billionaire who successfully […]

">

">

Do I Need an IRS Identity Protection Personal Identification Number (an IP PIN)?

by Dave Horwedel, EA The IRS is offering an IP PIN to taxpayers who request them. If you are concerned that someone may steal your refund or file something incorrect with the IRS under your name or Social Security Number, this offers an extra layer of protection. In prior years only taxpayers who had been the victims of Identity theft could apply. […]

">

">

Corporate Transparency Act Found Unconstitutional

By Dave Horwedel, EA, CEO of Torchlight and GuardDog Tax A federal district court in Alabama held that the Corporate Transparency Act (CTA), P.L. 116-283, which requires the reporting of Beneficial Ownership Information (BOI) by businesses, is unconstitutional. No Celebration Yet This is a lower court opinion that is sure to be appealed to the […]

">

">

ERC 2024: The Partial Suspension Test – ERC REVIEW and AUDIT DEFENSE

by Dave Horwedel, EA The Employee Retention Credit is in the news with the IRS sending out thousands and thousands of IRS Audit (aka Examination) Letters and offering a discount if you voluntarily withdraw your ERC . To understand what to do with your ERC, you need to understand the ERC “partial suspension” test. If […]

">

">

ERC 2024: The Gross Receipts Test – ERC REVIEW and AUDIT DEFENSE

by Dave Horwedel, EA It would seem by reading IRS announcements that ERC Law has changed or that the IRS has recanted on their earlier IRS Guidance. This is not true. Nothing has changed except the IRS has taken on a much sterner tone and is asking those who falsely claimed the ERC to voluntarily […]

">

">

The Story of Torchlight Tax

Hi. This is Dave Horwedel. I am an Enrolled Agent, EA, the highest federal tax credential, and the founder of Torchlight and Guard Dog Tax. I would like to introduce you to my firm. I apprenticed at another EA/CPA firm before starting my own practice in 2015 in Las Vegas. I started my firm working […]

">

">

Is the ERC Cancelled?

by Dave Horwedel, EA No. The ERC is not cancelled for those who submitted on or before 12/31/2023. The IRS has paid or is still processing these ERC claims. Are new claims being accepted? Proposed legislation ends acceptance of new ERC claims as of 12/31/2023, if the House and Senate agree, and it is signed […]

">

">

Should I Withdraw My ERC???

The IRS is offering a voluntary program that allows you to withdraw your Employee Retention Credit (ERC) if you have already received it, and “only” pay back 80% of what you received. Is this a smart move? Should you withdraw your ERC? Before you withdraw your ERC, or not, you should carefully review the impact […]

">

">

Taxes in Under a Minute by Torchlight Tax

by Dave Horwedel Learn to Maximize your deductions. Maximize your tax credits. Employee Retention Credit, R&D credit, child tax credit, earned income credit, solar tax credit. Maximize your assets while minimizing your taxable income. Create future income and assets by deducting expenses that create future income and assets. Defer taxes using 1031 exchanges and other […]

">

">

Best Small Business Tax Structure

By Dave Horwedel, EA There is a C-Corporation which is the major corporations like those you see on the stock market. C-Corporations have stockholders, and they can make a lot of money. They have corporate meetings and boards of directors’ meetings and so on. They pay 21 % corporate income tax on the profits that […]

">

">

Things You Need to Know Before You File

By Dave Horwedel, EA When people do not understand tax basics, or they do not keep up with changes in tax law and regulations, they can get into a lot of unnecessary trouble. The purpose of this article is to save you time and money. my firm we utilize the services of EAs, Accountants, CPAs, […]

">

">

How to Spot a Tax Scammer

By Dave Horwedel, EA I routinely get called by worried taxpayers who have been called by tax scammers. If you are worried that you might be getting called by a tax scammer, you are welcome to call me at 1-877-758-7797. I will be glad to help you. There is a basic point that makes you vulnerable […]

">

">

Tax Tips: Things You Need to Know Before You File

By Dave Horwedel,EA There are things you need to know before you file your tax return. When people do not understand tax basics, or they do not keep up with changes in tax law and regulations, they can get into a lot of unnecessary trouble. The purpose of this article is to save you time […]

">

">

2022 Taxes Are Done: Now What???

By Dave Horwedel, EA Most people have now filed their 2022 taxes, and if not, they are officially late. There may be a few exceptions to being late. For example: If you are in a federally declared disaster area or If you are on a non-calendar year basis If you filed your taxes and were […]

">

">

Our Complete ERC Process

At Torchlight Tax, the steps in ERC application and delivery are seven-fold.

">

">

How Does the ERC “Partial Shutdown” Test Work?

If you do not qualify for the ERC by the Gross Receipts Test, there is a second independent test that you take.

">

">

The Biggest Misconception about the ERC

There is a common misunderstanding among taxpayers and inadequately trained tax professionals. They think the IRS gives…

">

">

Should I Get a Reverse Mortgage???

by Dave Horwedel, EA A Story I knew a lady in her late 60s who was in good health and frustrated she could not do what she wanted to do in her “golden years.” She had worked hard all her life, mainly as a salesperson, and was still working in her own business, selling at […]

">

">

How to Minimize the Tax Hit on a Home Sale

by Dave Horwedel, EA Minimizing Tax on Sale of a Home If you’re looking to sell your home, you should take a close look at the exclusion rules and cost basis of your home to reduce your taxable gain on the sale. You are welcome to contact Torchlight Tax if you would like our assistance […]

">

">

Torchlight Tax is Hiring Now and for 2024

This is Dave Horwedel, EA and Founder of Torchlight Tax. We are now hiring EAs and CPAs who can crank out tax returns and/or do IRS Representation. Remote positions are available in addition to in-house positions. If you have your own tax practice but would like some part-time tax work to keep you busy, we […]

">

">

Employee Retention Credit for Plumbing and HVAC Firms – Do you Qualify or Not?

Getting an ERC, if you truly qualify, can be a huge boon for you and your business. There can be a lot of money involved.

">

">

Employee Retention Credit for Construction and Real Estate Development Firms-Do you Qualify or Not???

Getting an ERC, if you truly qualify, can be a huge boon for you and your business. There can be a lot of money involved here.

">

">

How to Minimize Audit Risk!!!

Taxpayers are terrified of audits. This is understandable. They can be a lot of hassle. However, if your tax

">

">

Taxpayer Bill of Rights 4: Your Right to Challenge the IRS’s Position and Be Heard

You have a right to disagree with the IRS. Sometimes, the IRS makes mistakes, and you can take a different..

">

">

The Taxpayer Bill of Rights 3: Your Right to Pay the Correct Amount of Tax

You have a fundamental right with the Internal Revenue Service, The Right to Pay No More than the Correct Amount of Tax.

">

">

Taxpayer Bill of Rights 2: The Right to Quality Service

Have you experienced the frustration and disappointment of encountering bad service when dealing with the IRS?

">

">

Taxpayer Bill of Rights 10: Ensuring a Fair and Just Tax System

Taxpayers have a RIGHT to be treated fairly by the IRS. This can be useful in asking for managerial assistance, an appeal to..

">

">

Taxpayer Bill of Rights 9: Your Right to Retain Representation

You have the right to choose an authorized representative of your choice to act on your behalf in your dealings with the IRS.

">

">

Taxpayer Bill of Rights 8: Your Right to Confidentiality

Taxpayers are sometimes worried that the IRS may use their confidential tax data improperly to their detriment.

">

">

Taxpayer Bill of Rights 5: Your Right to Appeal an IRS Decision in an Independent Forum

This right entitles you to a fair and impartial administrative appeal of most…

">

">

The Taxpayer Bill of Rights 7: Your Right to Privacy

You as a taxpayer have the Right to Privacy in dealing with the IRS. The article below, quoted directly…

">

">

Taxpayer Bill of Rights 1: The Right to Be Informed

It is good reading for all taxpayers. Knowing what the IRS must inform you of, and letting them know when…

">

">

Knowing Your Taxpayer Rights Can Save Your @#$%&!

What many taxpayers do not know is they have rights. These rights keep the power of IRS Goliath in check–if they are…

">

">

Payroll Taxes Can Save Tax Dollars/Create Refunds

The world changes. For many years, employers saved dollars by employing contractors. This is still a good….

">

">

Can You Deduct a Hobby?

You cannot deduct hobby expenses. But you can deduct business expenses. Many businesses started as hobbies. Many hobbyists, who turned their…

">

">

9 Current Tax Tips from the Carnivore’s Mouth

The fact is the IRS has sent out a bunch of tax tips that they consider worthwhile, and they are pretty good.

">

">

Tax Exempt Organizations Filing Deadline: May 15th

Tax-exempt organizations have certain returns they have to file in order to maintain their Tax-Exempt status.

">

">

401Ks – Roth versus Traditional

Below is an overview of both types and their tax implications, so you can make an informed decision. A traditional 401(k) allows you to set..

">

">

What to do if you missed the tax deadline

If you missed the deadline but filed an extension you’re probably in pretty good shape, as you avoided..

">

">

If you missed the tax deadline, these tips can help

The tax filing deadline has come and gone. If you didn’t file a tax return or an extension…

">

">

7 Tax Tips to Lower Stress & Save Money

Tax season can be a stressful time for many Americans, but it doesn’t have to be. Here are some tips to simplify the..

">

">

The Definitive Guide to the Employee Retention Credit

This article shows the employer how he can ensure his employee retention credit submission is correctly done.

">

">

Get Ready for Your COVID-19 IRS Audit

Just like in the castles of old, you wanted your castle ready before the enemy …

">

">

IRS Warning on the Employee Retention Credit

The IRS has issued a warning about improper Employee Retention Credit…

">

">

IRS Audit Defense

Your worst fear has occurred. The IRS is auditing you. Whether it is…

">

">

How to Deal With Unfiled Tax Returns

One of the most common tax problems is unfiled tax returns….

">

">

Unconfrontable Tax Debt

This is a common situation. For whatever reason, your IRS…

">

">

What If the IRS Is Threatening A Wage Or Bank Levy?

This requires a fast handling before your wage check shrinks…

">

">

Save Tax Dollars and Hassle by Acting NOW Before 2023 Tax Season

For many people, especially small business people, taxes…

">

">

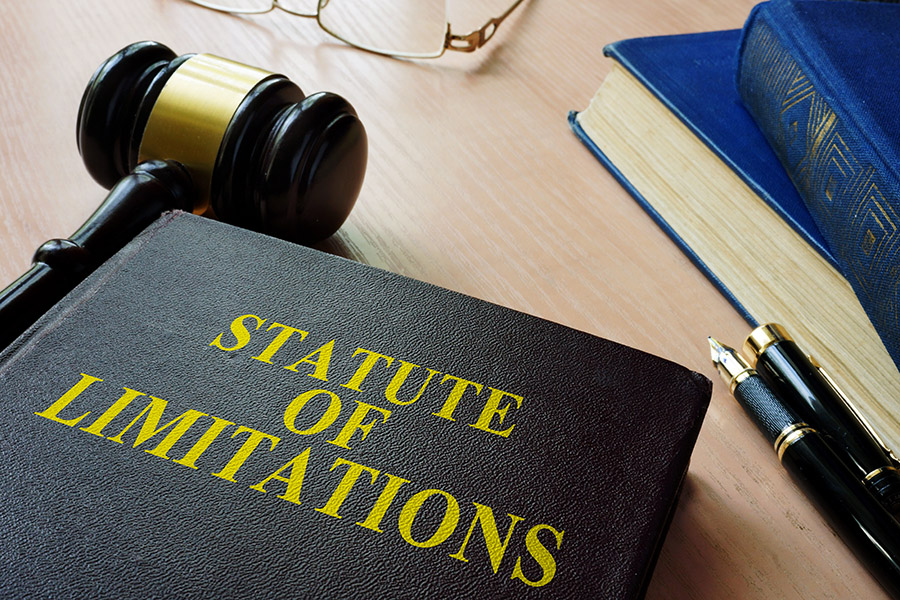

IRS Statute of Limitations – What It is!! How to use It!!

YES! There is one. There is a point beyond which IRS can no…

">

">

What to Do if You get a Letter from the IRS

Yes, it can be upsetting to receive a notice from the IRS. But the….

">

">

How to File an Amended Tax Return

Of course we all want the original return to be perfect. But sometimes…

">

">

Start Planning Now for Next Year’s Taxes

You may be tempted to forget about your taxes once you’ve filed your…

">

">

How to File Overdue Returns Without Raising a Red Flag

I have heard many taxpayers or potential taxpayers say something like…

">

">

What Is IRS Representation?

Hi. I’m Bruce Roth and my guest today is Dave Horwedel….

">

">

Best Business Structure for Taxes

Hi, my name is Bruce Roth, and my guest today is Dave Horwedel….

">

">

Torchlight Tax is Hiring

Torchlight Tax is expanding and we are hiring now and for the…

">

">

Employee Retention Credit: Benefits versus Risk.

There is a lot of false data out there about the Employee Retention Credit…

">

">

The Hidden Costs of Payroll and Bookkeeping

The visible costs of Payroll and Bookkeeping can be truly …

">

">

What is an Enrolled Agent & Do I need one?

An enrolled agent (or EA) is a federally authorized tax practitioner…

">

">

How to File an Amended Tax Return

Of course we all want the original return to be perfect. But…

">

">

What is The Self-Employment Tax?

An enrolled agent (or EA) is a federally authorized tax …

">

">

Is the Obamacare Tax Penalty Dead?

As a practical matter the Affordable Care Tax Penalty…

">

">

">

">