By Dave Horwedel, EA

This article shows the employer how he can ensure his employee retention credit submission is correctly done, so his ERC is safely maximized.

Many eligible employers are getting the maximum $26,000 per employee on their 2020-2021 payroll.

If you had over 500 full-time employees in 2020-2021, you are not eligible for the ERC as discussed here.

Also, only employers are eligible for ERC.

Employees are not eligible for ERC.

In maximizing ERC, one needs to make sure that all eligible employees are included, all eligible quarters are taken, and that company funds spent on health insurance are properly included.

One must also minimize the effect of forgiven PPP (Payroll Protection Program) loans that reduce the credit by allocating the forgiven PPP loan, as much as possible, to allowable non-payroll expenses.

One needs to be meticulous and precise in all the paperwork. The maximization is in the details.

If you, as an employer, have any questions about this, please go over this with us at Torchlight Tax.

We have found that handling the employer’s questions gives him peace of mind. The ERC was created by the CARES Act in 2020, and modified three times in 2021 by Congress, and signed into law by the president. The IRS has provided Guidance on how they interpret the ERC.

We make sure the ERC submission complies with the CARES Act, as amended, and also complies with IRS Guidance.

Crossing one’s fingers and hoping the IRS does not audit you, is a losing approach. It violates Murphy’s law!!

Far better to make sure that you have followed IRS Guidance and have a submission that is impervious to an IRS audit.

The best defense against an IRS audit is submitting for the ERC only if you qualify, and transparently documenting how you qualify.

This does NOT mean you leave money on the table.

A manager/employer is responsible to the owners and the firm, whether a sole proprietor, partnership, or a corporation. If eligible for the ERC, the employer should apply for, and get the ERC.

Our position is that there is a maximum amount of ERC you qualify for, and that our job is to analyze your situation and document that maximum amount, so that you can safely receive it.

If you had employees in 2020 and 2021 and experienced a negative impact on your business due to COVID-19 governmental orders, you very likely qualify.

But you must make sure that you frame your ERC qualifications in a way the IRS will agree to.

For example, the fact that you lost money does not qualify you. However, if in a 2020/2021 quarter, you were only able to produce less than 90% of goods and services that you had produced in a corresponding 2019 quarter, and this was the result of modifications required by COVID-19 governmental orders, then, that would be a qualifying point.

Yes. That’s probably why you lost money!!

The IRS guidance does not say if you kept your employees on payroll and lost money you qualify, but it does say that if COVID-19 governmental orders required modifications at your business that resulted in a greater than 10% reduction in your ability to deliver goods and services, you qualify.

The CARES Act and IRS Guidance are complex. Bookkeepers, general tax preparers, and payroll specialists rarely have much experience in reading and understanding Tax Law, IRS Guidance, and related IRS Regulations.

EAs, CPAs, and Tax Attorneys who have studied up on the ERC, are familiar with the Tax Code, IRS regulations, IRS guidance, and have significant experience in defending clients under IRS audit.

These are best qualified to ensure your ERC submission is impervious to an IRS audit.

IRS audits are dangerous to the ill-prepared.

There is a common misunderstanding amongst the public and even second-tier tax professionals as to how the IRS operates.

Here is an example as it applies to the ERC.

Suppose you had a small business and kept 50 employees on payroll throughout 2020-2021.

The employees made $800 plus per week, and you did not receive a Payroll Protection Program (PPP) loan forgiveness. If you qualify for the ERC, you could potentially get $1.3 million in ERC.

Now, even if you do not qualify for the ERC, you could potentially get $1.3 million in ERC.

WHAT?!?! No, that’s crazy!!

You made a mistake!!

No mistake.

Crazy, but true!!!

The IRS does not determine if you qualify for the ERC before sending you the refund.

This is what many employers, and some ERC filers do not understand.

To get an ERC refund, the filing firm files amended payroll tax return 941X and notes in the box why amending, “to claim the Employee Retention Credit under the CARES Act.”

That’s it! You are not required to state how you qualify.

There is factually no place to indicate how you qualify on the 941X form. The IRS does not want you to say how you qualify at this point. The IRS receives the amended 941X, the paperwork matches their records, the employer’s name, EIN (Employer ID Number), the employees’ names, Social Security numbers and amounts paid, et cetera all match. The returns are processed (by a computer) and refund checks are issued for $1.3 million. This is true whether you qualify or not. This is how the IRS operates.

Here is another example.

Have you ever gotten your personal tax refund deposited to your bank account two or three weeks after filing your tax return?

This happens all the time.

Did the IRS review your return carefully? No.

Did they make sure you were eligible for every credit or deduction?

No! Of course not.

With the volume of submissions, there was no time.

This is the same for the ERC, except the refund amounts are much larger.

Also, please note: The CARES Act extended the period the IRS can audit your ERC claim from three years to five years.

They have FIVE YEARS to review your claim, demand the ERC back, and add on penalties and interest.

Now, when you understand you will get an IRS refund, even if you don’t meet the qualifications for the ERC, and that the IRS could then charge you penalties and interest on the amount you receive, your priorities shift. Yes, the 941X must be correct. And yes, you maximize your ERC by doing this.

The most important thing is determining if you are eligible for ERC per the CARES Act and IRS guidelines, and this is not what bookkeepers and payroll specialists do.

Another example.

Suppose you had 99 W-2 employees in 2020-2021, and suppose your business boomed, and you’re not eligible for the ERC because your income and delivery skyrocketed.

You could get $2,000,000 plus in ERC by filing 941X forms.

But what then? Do you want to flee the country and live off the grid?

The IRS is very likely to find out and demand their money back with penalties and interest.

Sadly enough, if an unethical firm filed for you in this situation, and you paid them their 20% commission, they are likely to get away with it.

The IRS is not coming after THEM. They have no debt with the IRS.

You might go after them. But it probably would not be easy.

You, on the other hand, DO owe the IRS money.

The IRS does not have to go to court and prove you knowingly defrauded them. All they need to do is audit you, decide you owe them the money. and demand the ERC be returned with penalties and interest.

The IRS can levy your bank accounts without going to court.!

Now Torchlight Tax is an expert in IRS audit defense.

If we were asked to submit for an ERC in this situation, for a refund that you did not qualify for, we would not do so.

We are ethical and in business for the long haul.

We would not set you up for an IRS audit by helping you get ERC funds you were not eligible for.

The important thing is making sure that you as an employer qualify for the ERC and that this is documented.

Working with the employer is something an experienced EA, CPA or Tax Attorney who is well-versed in the ERC can figure out.

Many employers, and employees of ERC-only firms, do not even realize this is an issue.

When the ERC refund is received by an employer who does not qualify for it, the ERC-only firm collects their fee for the job and considers it a job well done.

In this scenario, the employer receiving the ERC and the ERC-filing firm are jumping up and down and high fiving each other. The ERC-only-firm, not being tax experts, likely do not realize they have set their client up for an IRS Audit.

Maximizing the ERC and making your ERC claim audit-proof requires real tax professionals working with your firm who honestly and meticulously document and confirm that you qualify.

If you do not qualify, a real tax professional will tell you, “No. You do not qualify.”

He will tell you “No” because he knows that an IRS audit would take the money back with penalties and interest.

As an employer, you cannot risk an IRS audit by having your ERC done by unethical or untrained ERC filers who do not have a full understanding of tax law and how the IRS operates.

Unless, of course, you want to leave the country and live off the grid.

You risk your business if you or your ERC filers are not fully trained and ethical.

MINIMIZING AUDIT RISK

How can one be safe from audit?

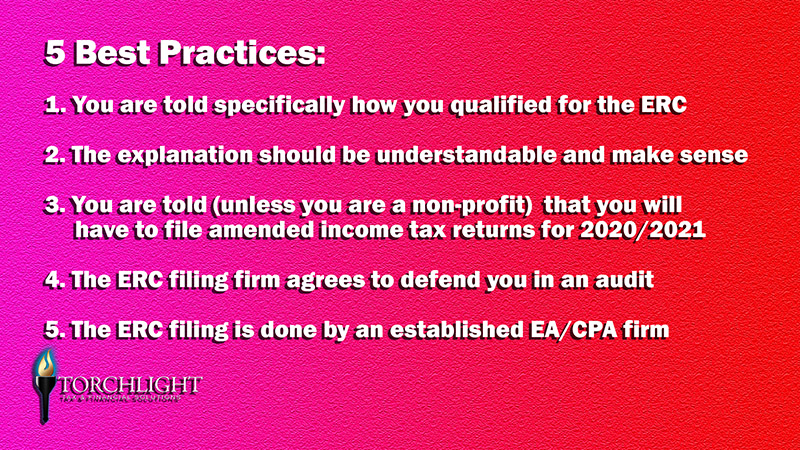

Here are five best practices that protect you when filing your ERC with a tax firm.

#1. You are told specifically how you qualify for the ERC, which should include what test you passed, and how you passed should be quantitatively explained.

#2. The explanation should be understandable and make sense.

#3. You are told (unless you are a non-profit) that you will have to file amended income tax returns for 2020 and/or 2021. Usually, the firm that does the ERC also does the amendment.

#4. The ERC filing firm agrees to defend you in an audit for the five-year audit window at no extra charge as part of their fee.

#5. The ERC filing is done by an established EA-CPA firm with a history of tax preparation and IRS representation beginning well before the ERC ever existed.

Before you file for your ERC, you should ask yourself “Will this firm be here for me if I get audited in the next five years?

WHAT SHOULD SET OFF ERC IRS AUDIT ALARM BELLS?

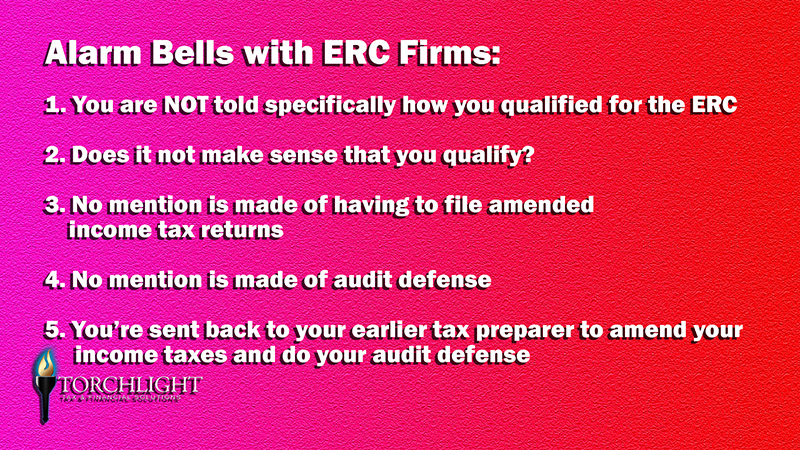

These are the alarm bells to listen for when a firm is working with you on an ERC submission.

#1. You are not told specifically how you qualify for the ERC. Did you qualify by Gross Receipts? If not, there must be a reduction of greater than 10% in your ability to deliver goods and services because of modifications required by COVID-19 governmental orders.

If it is only a narrative about wearing masks and making meetings by zoom calls, but no quantitative analysis, this is a huge red flag and alarms should go off.

#2. Does it not make sense that you qualify?

#3. No mention is made of having to file amended income tax returns. (All that is mentioned is the 941X that is filed to get the refund.) But after the 941X is filed, amended income tax returns must be filed for 2020 and/or 2021 to reduce your business payroll expense by the amount of the ERC. A real tax firm that is planning to be around is going to tell you about this and is going to want to file your returns.

They would want you as a future client.

#4. No mention is made of Audit Defense.

Why would they not talk about audit defense?

This may mean that they are not qualified or competent in audit defense and are not going to be around to help you in the event of an ERC audit.

#5. You are sent back to your earlier tax preparer to amend your income taxes and do your audit defense.

Wait a second!

Didn’t they get your business by convincing you that they knew better than your regular guy?

Why would a tax firm not want to do your income tax return?

Why would they not want you as a future customer? Are they planning on being gone?

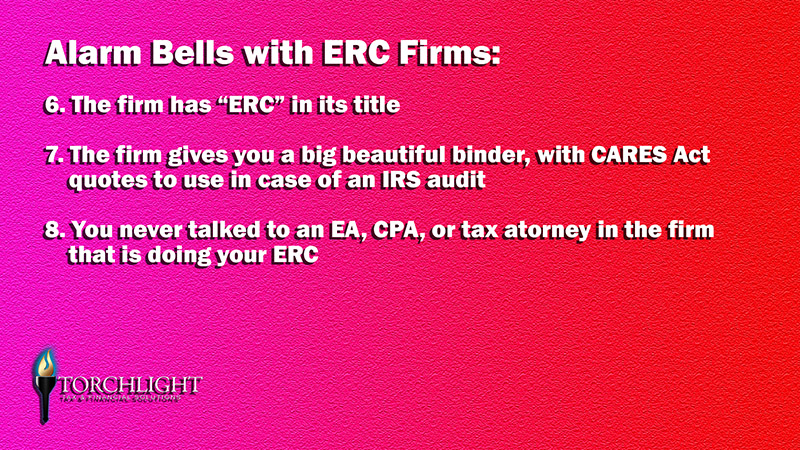

#6. The firm has ERC in its title.

The ERC has limited duration.

ERC in the firm’s title is an indicator the firm may cease to exist after the ERC refunds stop coming out and before the IRS audit letters start arriving.

#7. The firm gives you a big, beautiful binder with all kinds of CARES Act quotes to use in case of an IRS audit.

They stuff inside the binder your 941X and a little explanation of why you qualify, and you are told you could use this in the event of an IRS audit.

Wait a second!

The IRS is not going to read the CARES Act binder!

If they send you an audit letter. they are going to ask specific questions about how you qualify!

You must answer their specific questions.

These questions as to how you qualify should be ready BEFORE you submit.

This is how we do it at Torchlight Tax.

A question to ask yourself is, are they giving you the big book because they’re not going to be around in the event of an audit?

#8 You never talked with an EA, CPA or tax attorney in the firm that is doing your ERC.

Beware of assurances that a lawyer, EA or CPA wrote the binder or is overseeing everything, if you have never talked to him. Who is going to talk to the IRS if you get an audit letter?

Now some of 1 to 8 above may be explainable.

I’m not saying that all ERC-only firms are bad.

But these points should be looked at.

QUALIFYING FOR THE ERC: THE GROSS RECEIPTS TEST

Now we’re going to go over the quantitative tests that qualify employers for the ERC.

The first is the Gross Receipts Test.

For 2020, one quarter must be down greater than 50% compared to the corresponding quarter in 2019.

For 2021, a quarter qualifies if it had a greater than 20% reduction compared to the corresponding 2019 quarter.

To make things a bit more complex, the first quarter after a qualifying quarter for that year gets paid the ERC as well even if you did not qualify by gross receipts.

A new start-up after 15 February 2020 can also qualify for quarters three and four of 2021.

OTHER QUALIFYING TESTS

If you do not qualify by the Gross Receipts test, there are other qualifying tests. In general, you must connect a greater than 10% reduction in your ability to deliver goods and services to federal, state, or local COVID-19 governmental orders that caused the reduction. There are also tests where there was a 100% shutdown of a business or part of it. There is also a test where federal, state or local governmental orders caused supply chain disruptions that impacted your ability to deliver goods and services by greater than 10%.

Now the important thing to know about these tests, is that they have a quantitative aspect.

You cannot have a narrative with no numbers that qualifies you.

You can have a narrative, but it must point to a greater than 10% reduction, and you must state the reduction occurred.

No narrative is needed for gross receipts test.

Example:

A business does not pass the gross receipts test. An analysis is done that explains how Covid-19 governmental orders impacted the business, resulting in an 11% reduction in the delivery of goods and services that compared to the corresponding 2019 quarter. This supports the fact that the business has a greater than 10% decline in its ability to deliver goods and services.

Now, Torchlight Tax does a lot of IRS representation.

We have represented thousands of taxpayers before the IRS. Audits are no big deal to us.

New clients come to us for audit defense when they receive an audit letter.

Audits are only a serious problem when the original return was done wrong.

If your return was done correctly, you will win the audit!

Yes, we have all heard horror stories about IRS Audits.

No one likes them.

The IRS can be capricious and arbitrary.

However, if your accounting and documentation is perfect, and your tax return preparation flawless, you’re not likely to have a problem.

One might say that the IRS can be capricious and arbitrary when there is a chink in your accounting or tax preparation.

The way to be safe from an IRS Audit is to be so well-prepared that you hardly care if they audit you or not!

Now, other than gross receipt tests, there are other ERC tests that require some WORK.

Look at our example above.

We’re talking $1.3 million. If it took 1,000 hours of work to work out the details to support your ERC claim, you would be getting $1,300 for each hour of that work. Of course, it’s not going to take 1,000 hours, but it’s worth time and effort to build the foundation for your ERC submission.

People hate taxes. They don’t want to deal with IRS rules. It’s amazing how quickly some are ready to throw away a couple hundred thousand dollars of IRS refund because it’s too painful to confront the paperwork.

But bear with us.

I have spent hours on the phone with an employer pinning down how he qualifies for the ERC.

He was ready to give up at 15 minutes. But we figured it out and he was glad we did!!

Example: You have a cleaning service with 70 W-2 employees that you kept working in 2020-2021. You have a slim profit margin and are by no means rich. Your Gross Receipts do not qualify you for the ERC.

How can you show a 10% reduction? Suppose you had a statistic of square feet cleaned or maintained. Suppose that governmental orders required more social distancing, smaller crews, that you had supply chain shortages (caused by Covid-19 Governmental Orders), et cetera. All these resulting in a statistic being down for each quarter compared to 2019 by 15 to 45%.

You could have a narrative about all the extra work required by Covid-19 governmental orders to do the same quantity of cleaning.

You confirm it by this statistic. A case could be constructed around this that you had a greater than 10% reduction in your ability to deliver goods and services for Quarters 2,3,4 of 2020 and Quarters 1,2,3 of 2021. This qualifies you for the ERC for all the quarters.

Now, this is just an example. But the point is the employer and the tax expert would agree that this is a real thing, and they could quantify it and make a clear, understandable case that this business qualifies for the ERC.

One other point–If you as a business owner went through Hell to get through 2020 and 2021 and survived. But you do not qualify per the Gross Receipts Test, I would recommend you thoroughly review what happened with an expert from Torchlight Tax.

Maybe you did not qualify. If you don’t qualify, you should walk away from filing for an ERC.

However, if it took HERCULEAN EFFORTS to keep your firm alive, we should look carefully at what happened and see if you qualify by another test.

Let’s suppose you have worked with Torchlight Tax and you qualify by gross receipts, or you qualify because you are able to show that you had greater than 10% reduction in your ability to deliver goods and services because of modifications required by COVID-19 governmental orders or supply chain disruptions created by Covid 19 governmental orders. You need have no worries about an IRS audit in a situation like this.

This is not because you will not be audited. It’s because even if audited, you will prevail.

Of course, your data must be accurate as our analysis is based on your data.

Now, once the refund is received, we are not done.

Businesses must file amended 2020 and 2021 tax returns. Usually, we file these for our clients. (Please note, this would not generally apply to nonprofits.) Then we stand by for five years to respond to any IRS correspondence or audits on your ERC.

You do not have to respond to IRS ERC correspondence. Send them to us and we will respond and let you know how we responded.

And yes, we would be glad to file your taxes for the next few decades!

You do not have to use us, but we want to do as many tax returns as we can.

That’s our business.

Torchlight Tax is a full service tax firm founded by Dave Horwedel, EA (Enrolled Agent).

Guard Dog tax was formed by Torchlight to specialize in IRS representation.

We are a team composed of EAs, CPAs and support personnel.

We do personal and business taxes of all kinds.

We clean up tax messes every day. We represent clients before the IRS.

We are here to stay and build our business by excellent service and results.

You’re welcome to visit our websites.

We have excellent reviews and are proud of our work.

We would like you to get your maximum ERC without exposing yourself to audit risk. If you’re an employer who had W2 employees in 2020 and 21, please call us at 702-463-1818 or e-mail us at info@torchlighttax.com or fill in the consultation form on this page.

We will do everything we can to get you all the ERC you can safely get. We look forward to hearing from you.

If this information has been helpful, please share this article.

The more people who read it, the more who will benefit from the ERC, and fewer employers will get themselves into IRS trouble by filing for the ERC when they do not qualify.