by Dave Horwedel, EA

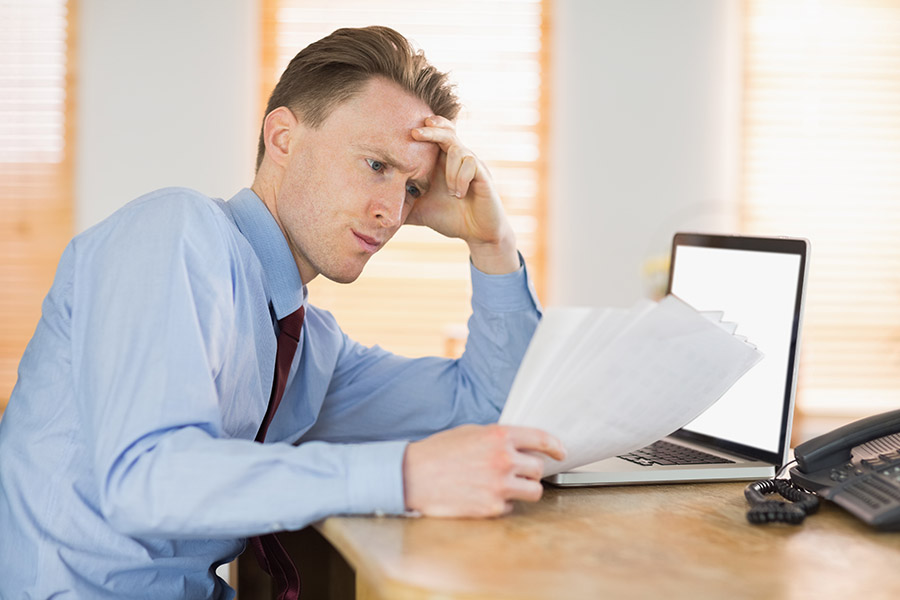

First, do not panic!!

Yes, it can be upsetting to receive a notice from the IRS. But the first step is to take a deep breath and calmly read the notice or letter.

The notice or letter states the reason it was sent, its purpose, and instructions on how to respond.

In the corner is a notice number. This number also prints on the lower left hand side of the tear-off stub included with the notice or letter.

The IRS website has a table explaining each type of notice by number. Match your letter’s number with the number in the table to get more information.

Read it carefully and make sure you understand what it is saying. If you do not understand it, do not guess.

Maybe there are some odd words there you can look up in a dictionary or on the internet. Maybe a friend who “speaks tax” can translate it for you.

VERY IMPORTANT!! Do not carry on if you do not understand the notice. Get help from an EA, CPA, or Tax Attorney. We have all of these here to service you at Torchlight Tax.

Once again, you are welcome to contact Torchlight Tax and we will help you make sense of it as part of a free consultation.

Normally there is a specific issue related to your account or tax return. Maybe you are getting a larger refund than expected, and that is why the notice has arrived.

What a waste it would be if you had a heart attack seeing you had an IRS letter, and never collected on the refund.

Maybe the IRS found a small math error in your return and your tax bill has gone DOWN. No reason to panic here.

Of course, maybe you do owe substantially more, or the IRS is requesting additional data. Panicking is not going to help.

You can contact us and get a free consultation with one of these tax experts. As Confucius might have said “The wise man knows when he is in over his head.”

What next?

You generally have 30 days to respond to an IRS notice. Do not ignore it. Always check which tax year the notice relates to. It may not relate to the current tax year at all. Make sure the instructions are clear. Do not try to execute instructions you do not understand.

The notice may request more information or ask a specific question. If it’s a minor issue and you are confident of the facts, you can respond to the notice yourself. But sometimes, you may need to seek help from a tax professional.

You are welcome to contact us at Torchlight Tax.

If there is something wrong with your tax return or you need professional assistance, the sooner you get it, the better.

If you are facing a substantial tax bill, or you or your tax preparer made major errors in your return, then an EA or CPA from Torchlight Tax may save the day.

I had one client who had made an error in his self-prepared return and was panicked to receive a letter from the IRS. When I reviewed his taxes, I was able to resolve the IRS question in a few minutes.

He had made a mistake entering income on his tax form. While a professional in his own field and well-paid for it, he did not “speak tax” and had simply guessed where to enter an income item.

When it was corrected, he did not owe the IRS any more money. I filed an amended return for his federal and California income tax. The federal return was a wash.

But I needed to amend it to file the amended California return. The amended California return refunded him over $8,000 refund! He had made another mistake!

Now back to the notice you received from the IRS. You may have received a correction notice or a notice of unreported income. Does the notice make sense?

Compare the IRS adjustments with the information on your tax return. If the adjustments make sense and you see they are correct, you can reply to the IRS with payment for the additional taxes due. Before you do so, ask yourself honestly. Might there be further errors in my favor.

Now, as the IRS has already reviewed your return and made their adjustments, further adjustments against you are very unlikely. This can include state as well. Remember the 8,000 California refund I mentioned above came from an IRS letter.

You are welcome to contact us if you think there might be errors in your favor missed.

If the IRS correction seems wrong, proceed to the next step.

If you do not agree with the notice

If you do not agree with the notice, make sure you understand it. Now might be a good time to seek professional assistance.

The notice might seem silly, frightening, or foreboding to you, but might be old hat to one of our CPAs or Enrolled Agents.

Do not procrastinate or put it into your shredding. Get help if you need it.

If you are in over your head, get it over to an EA or CPA and get his advice, or give him the ball and let him run with it.

Either you or an EA or CPA or Tax Attorney will need to respond within the thirty days with your reasons for disagreeing and enclose copies of all relevant documents.

Allow at least one month for the response.

The important thing is to respond – ignoring notices will get you nowhere and could result in additional negative consequences. And if you or your tax preparer made a mistake, now is an excellent time to correct things. Do not leave it for the IRS to work out!

If you cheated on reporting your income or entered a bogus deduction, no need to start planning your retirement to San Quentin. Have an Enrolled Agent or CPA look over your returns and correspondence. We would be glad to help you.

Even if it was simple human error, a review of your taxes would be wise.

If you or your preparer made one mistake, maybe there is another. Our EA or CPA can always file an amended return, state that a mistake had been made, and turn in an error-free return that gives you the maximal legal deductions and minimal tax bill.

If this is all that happened, the IRS is unlikely to take any further punitive action.

Chances are the return our CPA/EA does will give you more tax benefits than letting the IRS figure out your tax bill.

A couple words of caution. Be realistic about your or your preparer’s tax knowledge. If you or he did not know what you were doing, do not make the same mistake again.

Another word of caution. Do not have blind faith in the IRS and operate solely off their advice. It is not true that every IRS agent is attempting to maximize your tax bill. But they are not trained to minimize your tax bill either.

You are invited to contact Torchlight Tax for a free consultation. Call us at 877-758-7797 or email us at info@torchlight.com.